Cook County Senior Freeze 2025 Deadline

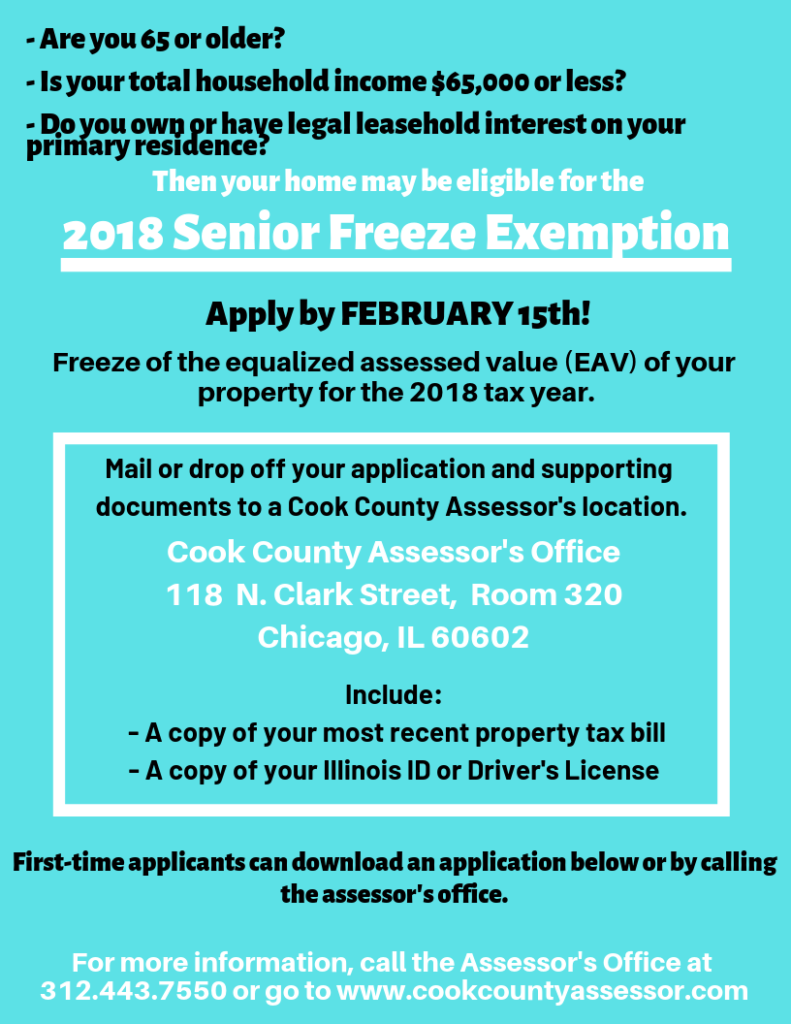

BlogCook County Senior Freeze 2025 Deadline. Be at over 65 years old. Retirees and other older homeowners on fixed incomes may reduce their tax bill by taking advantage of senior freeze. to qualify for the “senior freeze” exemption, the applicant must:

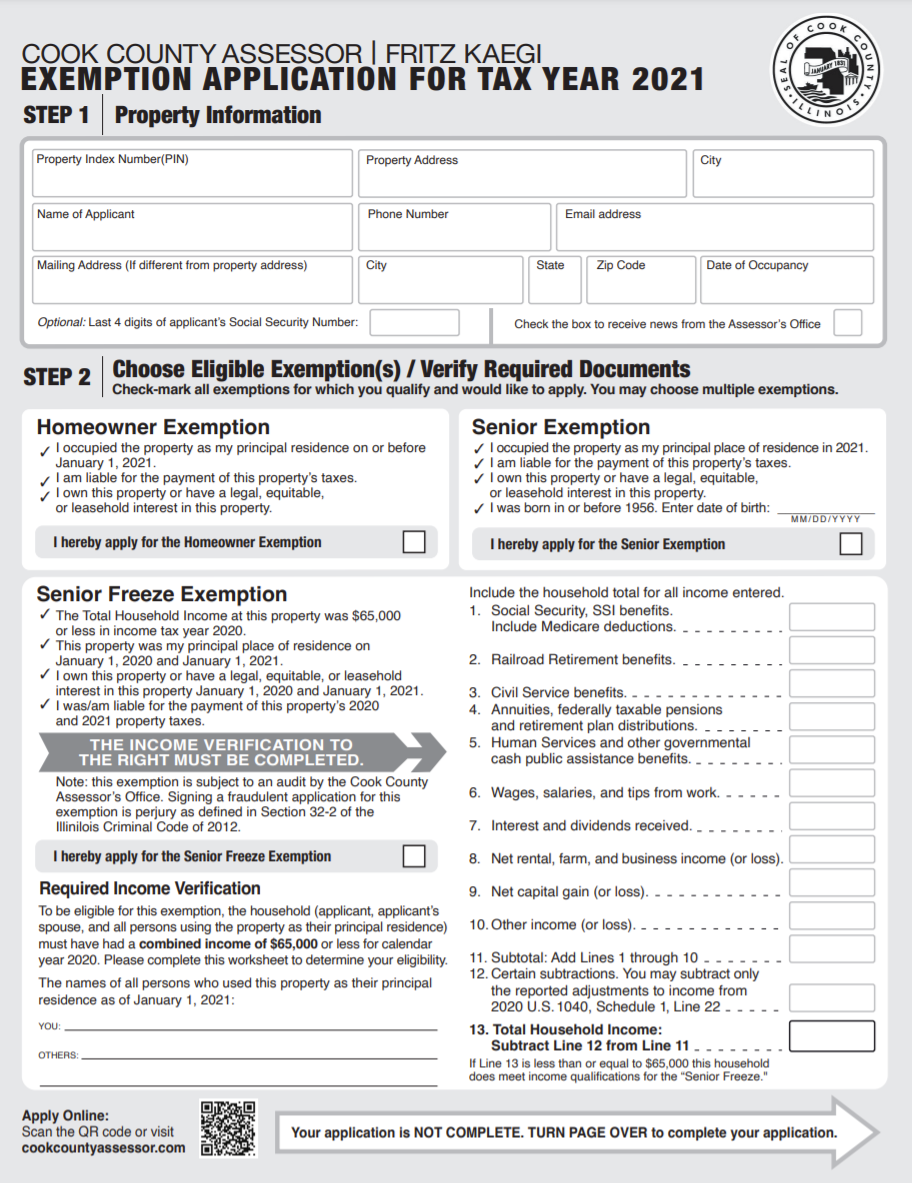

This filing allows you to apply for the following exemptions: Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2025 calendar year.

For the 150 households, we are conducting ongoing investigations to determine whether they are eligible for the senior freeze and whether they must pay.

A senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property.

Application deadline extended for Cook County senior property tax, Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2025 calendar year. A senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property.

Deadline Extended for Property Tax Exemptions! Alderman, Cook county assessor joseph berrios announced today that his office has extended the deadline for the senior citizen exemption and senior freeze exemption Be at over 65 years old.

DEADLINE TODAY Cook County Senior Citizens Assessment, When do i apply for a senior freeze exemption? Cook county assessor fritz kaegi announced that the deadline to apply for property tax exemptions is friday, august 4.

Deadline to Apply for Exemptions The deadline to apply for the, State legislation now considers homeowners enrolled in. This filing allows you to apply for the following exemptions:

How much is the Senior Freeze exemption in Cook county? YouTube, Most homeowners are eligible for this exemption if they. This filing allows you to apply for the following exemptions:

Senior Freeze Exemption Cook County Assessor 2016 Printable Pdf, Cook county assessor joseph berrios announced today that his office has extended the deadline for the senior citizen exemption and senior freeze exemption The deadline to apply for.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F22821348%2FSenior_freez_page_1.png)

Cook County Senior Freeze Form 2025 Printable Forms Free Online, This filing allows you to apply for the following exemptions: Cook county assessor joseph berrios announced today that his office has extended the deadline for the senior citizen exemption and senior freeze exemption

‘Senior tax freeze’ homeowners told by Cook County Assessor Fritz Kaegi, The senior exemption is available to seniors in all municipalities in cook county. Most homeowners are eligible for this exemption if they.

Senior citizens owed as much as 45M in unclaimed Cook County Senior, Seniors must apply for the exemption each year to receive the benefit. Cook county assessor fritz kaegi announced that the deadline to apply for property tax exemptions is friday, august 4.

What is Senior Freeze exemption in Cook County? Best Tax Service, Seniors must apply for the exemption each year to receive the benefit. Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2025 calendar year.